In another milestone for the crypto industry, Canada plans to launch spot Solana exchange-traded funds.

Bloomberg’s ETF expert Eric Balchunas revealed that the Ontario Securities Commission (OSC) officially approved multiple SOL ETFs from top Canadian asset managers, including Purpose Investments, Evolve ETFs, CI Global Asset Management, and 3iQ.

Canada is readying spot Solana ETFs to launch this week after regulator gave green light to multiple issuers incl Purpose, Evolve, CI and 3iQ. ETFs will include staking via TD

With Canada’s Solana ETFs scheduled for April 16 debut, attention has turned to possible SOL price reaction.

Could the optimistic development help the alt overcome the key resistance at $150 this week?

Such a move would propel prices to $180 – a nearly 40% surge from current prices.

Staking rewards and top player support spark optimism

Canada’s Solana ETFs have grabbed the crypto community’s attention as they feature staking rewards, which are uncommon in traditional ETF models.

Moreover, top players will back the initiative.

First and foremost, TD Bank Group will offer staking services, allowing investors to earn passive income through exchange-traded funds.

The move underscores increasing institutional trust in the Solana project.

Balchunas believes the smooth authorization highlights Canada’s progressive outlook on cryptocurrency regulation.

Noteworthy, Canada was the first nation to approve spot Bitcoin ETFs in 2021, ahead of the United States.

Solana is among the top L1 networks known for its low fees and fast transaction speed.

The altcoin has witnessed increased investor interest because of its vibrant ecosystem, propelled by meme coins and DePIN projects.

The ETFs will offer regulated and direct exposure to the Solana network, promising an opportune on-ramp for retail and institutional players.

Furthermore, staking rewards mark a lucrative shift, allowing ETF holders to earn returns without interacting with components such as validators, crypto infrastructure, and wallets.

Meanwhile, the SOL ETF launch this week could trigger similar products globally.

That could also influence US watchdogs to progress with the pending decisions on spot altcoin ETFs, including Ethereum’s.

SOL price outlook

Canada’s SOL ETF debut will likely spark bullish moves for the alt’s price.

Solana trades at $131 after gaining over 20% within the previous week.

The alt requires a weekly candlestick closing above the $120 resistance to shift its short-term course to bullish.

Meanwhile, SOL bulls target the obstacle at $150, beyond which the alt could surge to the key level at $180.

That would mean an over 37% value increase from Solana’s current price.

Technical indicators support the upside as Canada’s ETF approval gains steam.

The Relative Strength Index has recently surged past the neutral 50, reading 54 at press time.

That confirms a potential momentum shift to bullish.

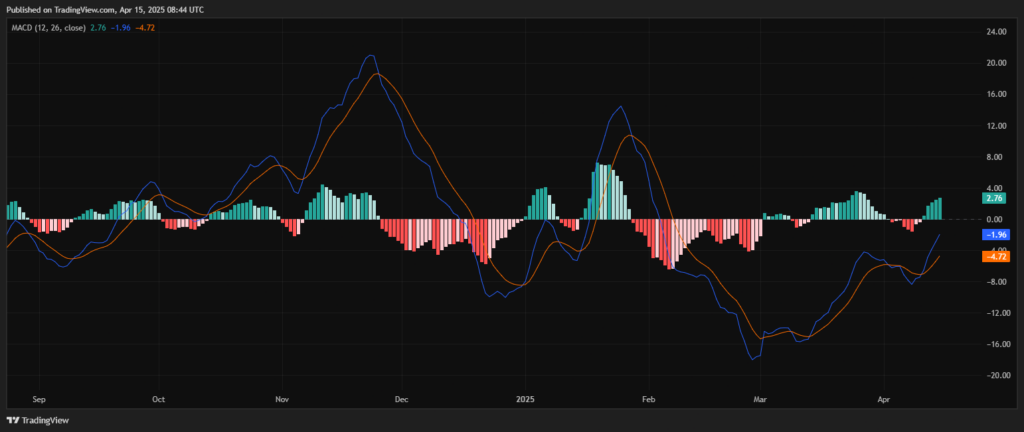

The 1D MACD supports the upside case with a visible bullish crossover.

The robust green histograms indicate a buyer resurgence.

Thus, Canada’s spot SOL ETF launch this week could catalyze the imminent short-term rally.

The post Canada to launch world’s first Solana spot ETF on April 16: could SOL jump 40%? appeared first on Invezz