Staples and Tech Swap Positions Again

The weekly sector rotation continues to paint a picture of a market in flux, with defensive sectors gaining ground while cyclicals take a step back. This week’s shifts underscore the ongoing volatility and lack of clear directional trade that’s been characteristic of recent market behavior.

The sudden jump in relative strength for defensive sectors last week has pushed Consumer Staples back into the top 5 at the cost of Technology.

- (1) Industrials – (XLI)

- (3) Utilities – (XLU)*

- (6) Consumer Staples – (XLP)*

- (2) Communication Services – (XLC)*

- (4) Financials – (XLF)*

- (5) Technology – (XLK)*

- (8) Real-Estate – (XLRE)*

- (9) Materials – (XLB)*

- (7) Consumer Discretionary – (XLY)*

- (11) Healthcare – (XLV)*

- (10) Energy – (XLE)*

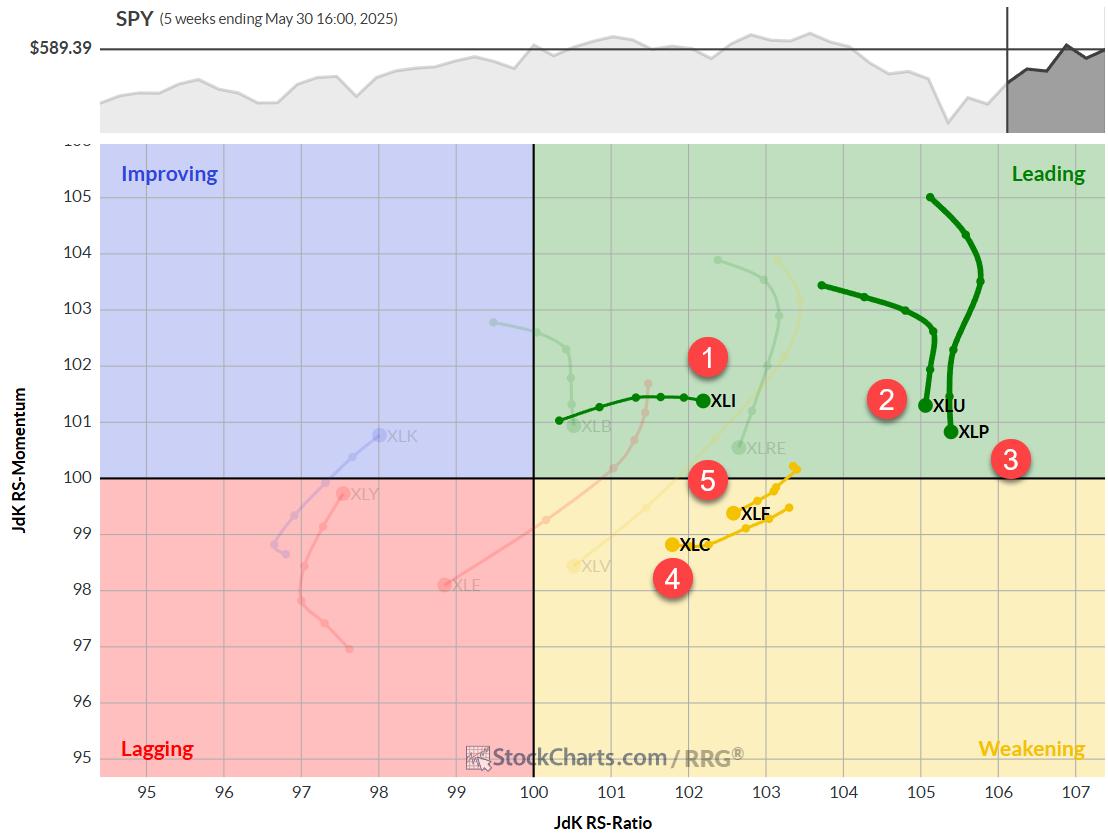

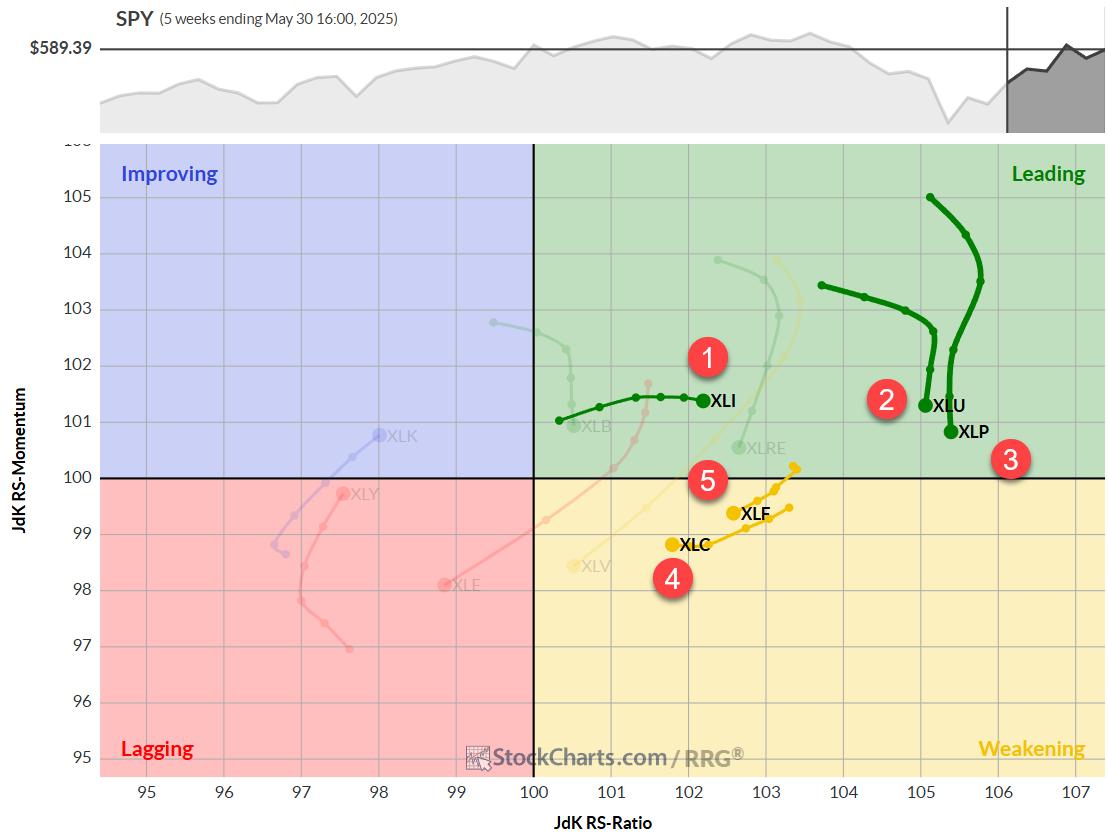

Weekly RRG

Looking at the weekly Relative Rotation Graph (RRG), we’re seeing some interesting movements. Industrials continues its upward trajectory on the RS-Ratio scale, solidifying its top position.

Meanwhile, utilities and consumer staples — our #2 and #3 sectors, respectively — are maintaining high RS-Ratio levels despite a momentum setback.

Communication services and financials, rounding out the top 5, find themselves in the weakening quadrant.

However, they’re still comfortably above the 100 level on the RS-Ratio scale. This positioning gives them a good shot at curling back into the leading quadrant before potentially hitting lagging territory.

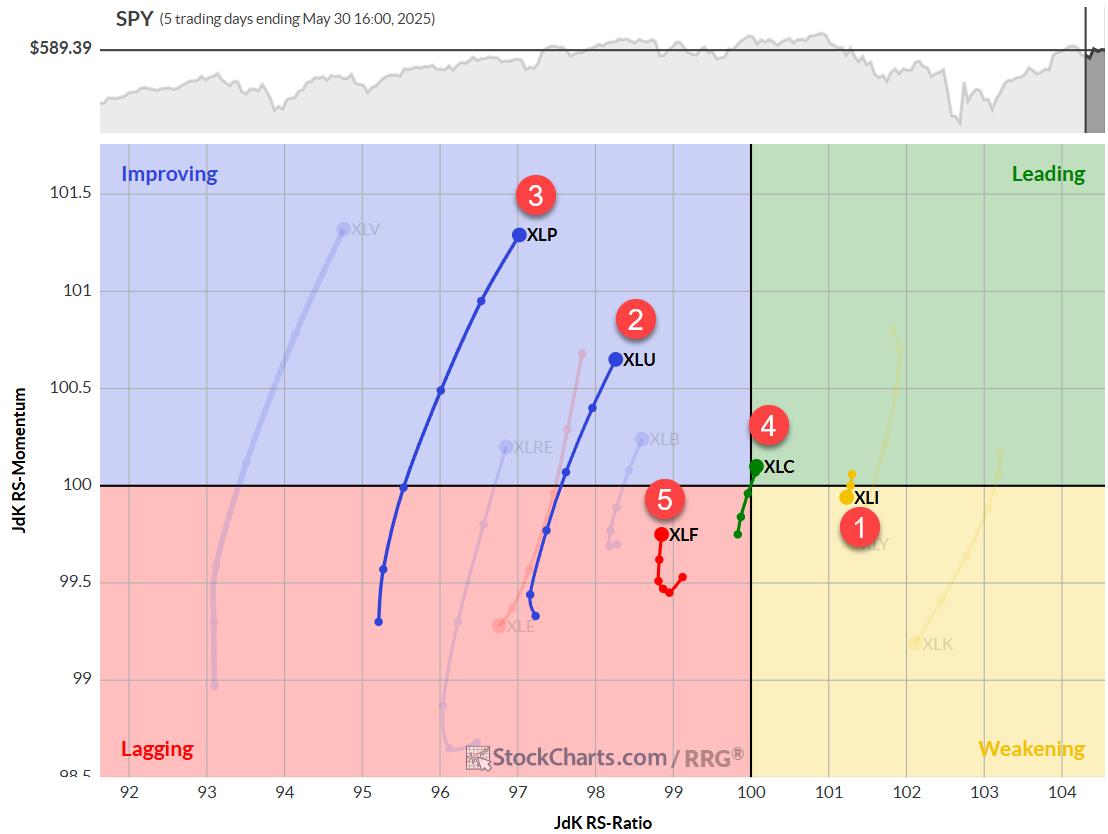

Daily RRG

Switching to the daily RRG, we can see some significant moves over the past week.

Consumer staples have made a considerable leap, landing deep in the improving quadrant with the highest RS-Momentum reading. This surge explains its return to the top 5.

Utilities isn’t far behind, also making a strong move into the improving quadrant.

Financials, while in the lagging quadrant, are showing less dramatic movement compared to staples and utilities.

Its shorter tail on the RRG indicates a less powerful move, but its high position on the weekly RRG is keeping it in the top 5 — for now.

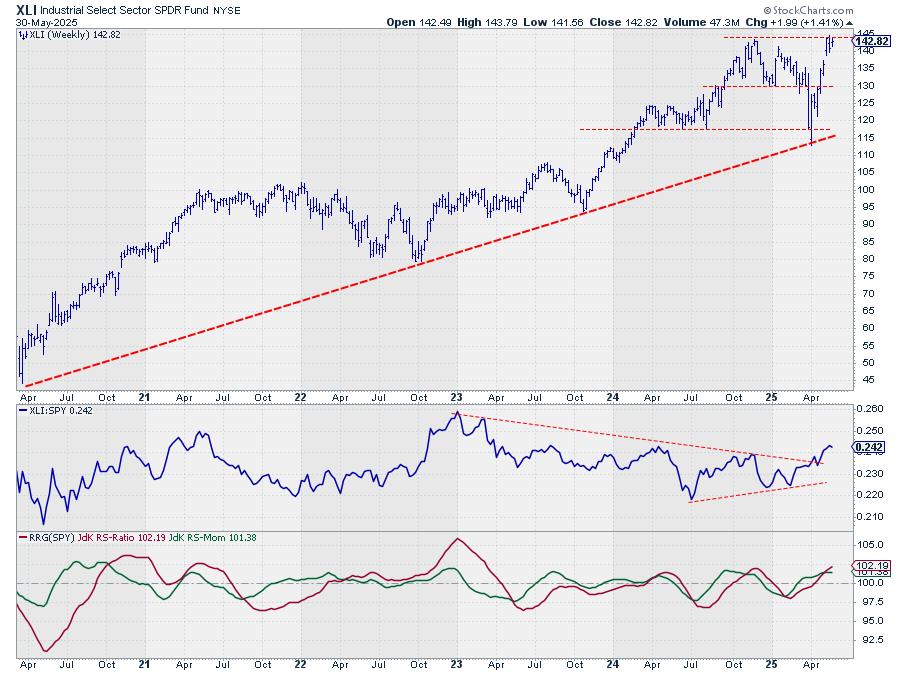

Industrials: Strength Confirmed

The #1 sector is pushing against overhead resistance around 143 for the third consecutive week.

A break above this level could trigger an acceleration higher.

The relative strength chart vs. the S&P 500 has already broken out, continuing to pull the RRG lines upward.

Utilities: Bouncing Back

After a weak showing two weeks ago, utilities closed last week at the top of its range.

There’s still resistance lurking just below 85 (around 84), but a break above could spark a rally.

The raw RS line is grappling with the upper boundary of its sideways trading range, causing the RRG lines to roll over while remaining in the leading quadrant.

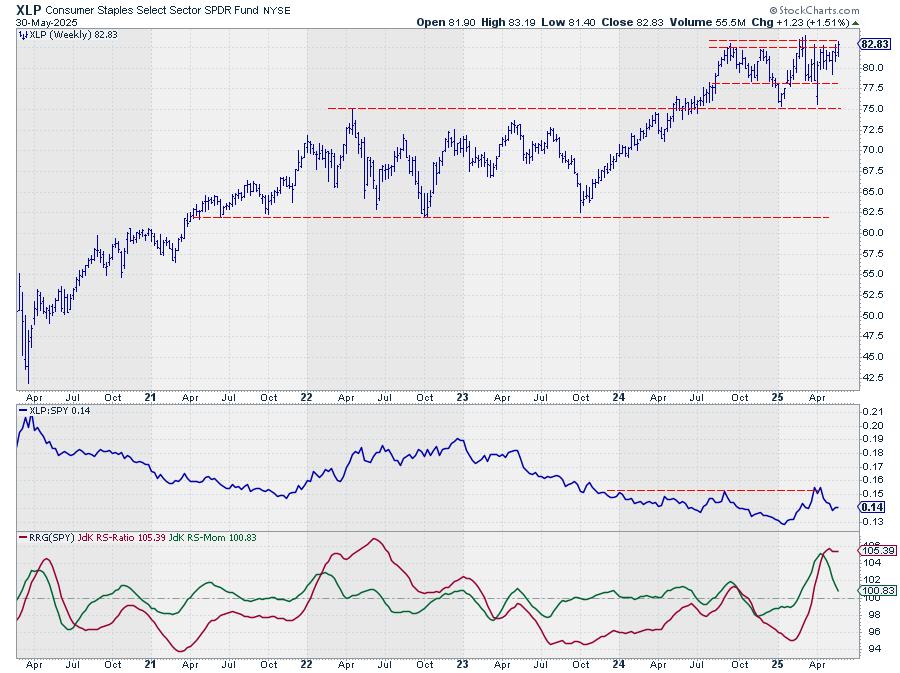

Consumer Staples: Testing Resistance

Staples has rebounded to the upper boundary of its trading range, with key resistance between 82 and 83.50.

A spike to $83.90 represents the recent high-water mark. Breaking above this barrier could accelerate the move higher.

The raw RS line has peaked against overhead resistance and needs to form a new low to support the RRG lines.

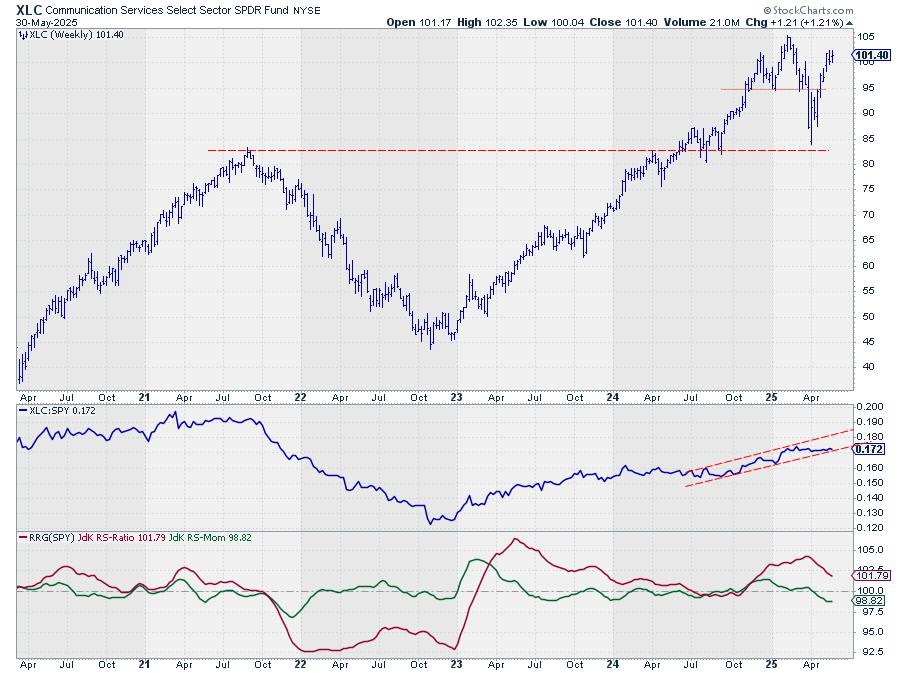

Communication Services: Holding Steady

XLC is trading around $ 101.40, with overhead resistance a few dollars away, near $ 105.

The raw RS line remains within its rising channel, but we’ll need to see improved relative strength soon to maintain this positive trend.

The sector sits in the weakening quadrant but has the potential to push back into leading territory with a strong relative strength (RS) rally.

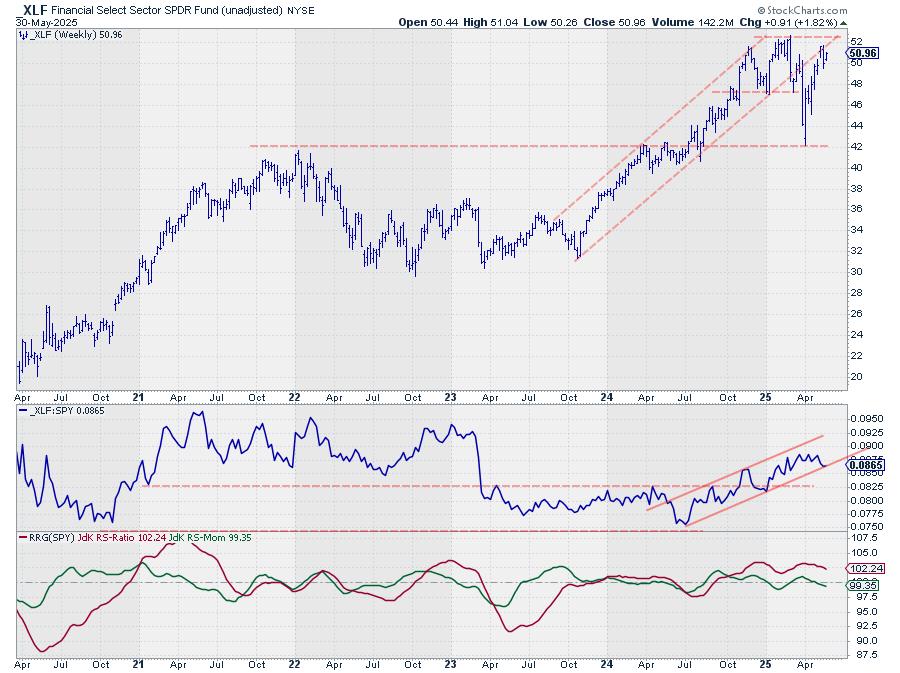

Financials: At a Crossroads

The financial sector is struggling with old resistance that’s now acting as support.

Its RS line is testing the lower boundary of its rising channel.

Financials needs a couple of strong weeks in both price and relative strength to maintain its top 5 position.

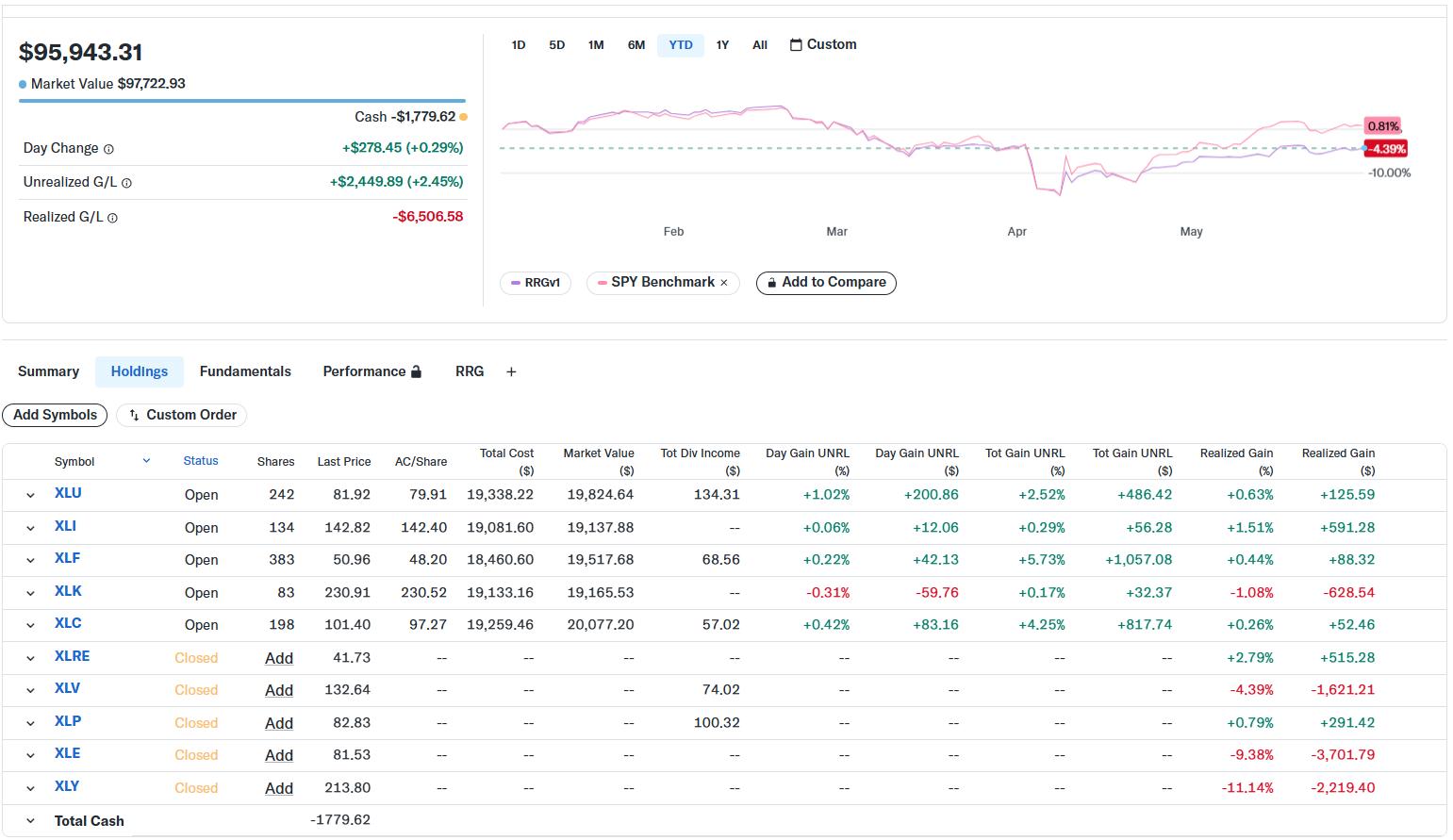

Portfolio Performance

As of last Friday’s close, our model portfolio is lagging the S&P 500 by just over 5%.

This performance gap has widened slightly from last week but remains in line with the volatile sector rotations we’ve been seeing.

The current market environment presents an apparent dilemma for sector rotation strategies. While defensive sectors are gaining prominence, cyclicals are taking a back seat — at least for now.

This flip-flop situation is common in volatile markets seeking direction, but it’s causing more frequent trades in our model than we’d typically expect.

For meaningful trends to emerge, the market needs to stabilize and establish a clear directional bias. Until then, we’re likely to see continued back-and-forth movement as investors grapple with mixed economic signals and shifting sentiment.

#StayAlert and have a great week. –Julius